The Pell education grant, provides up to $7,395 for college students in need. Unlike loans, this grant doesn’t need repayment. Here, you’ll learn how to apply for this essential financial aid and maximize its benefits.

Key Takeaways

- The Federal Pell Grant is a non-repayable financial aid designed to assist low-income undergraduate students with educational expenses; eligibility is assessed through the FAFSA based on financial need and expected family contribution.

- Students can receive up to 150% of their scheduled Pell Grant award by enrolling in three terms within an academic year, allowing for flexibility and increased funding opportunities.

- To maintain Pell Grant eligibility, students must complete a minimum number of credit hours, maintain satisfactory academic progress, and submit the FAFSA annually by the required deadlines.

Understanding Education Grants

The Federal Pell Grant, named after U.S. Senator Claiborne Pell, is a cornerstone of the federal Pell Grant program, federal student aid and federal aid, designed to help students with significant financial need pursue higher education. Unlike loans, Pell Grants provide pell grant money for college that does not have to be paid back, making them a crucial resource for many students.

The primary objective of the Pell Grant is to assist low-income students in covering the costs associated with college. These grants can be for various expenses, including tuition, books, supplies, room, and board. However, Pell Grants may not cover the entire cost of college, so students might need to find other funding sources.

The Free Application for Federal Student Aid (FAFSA) process determines Pell Grant eligibility by assessing financial need, Expected Family Contribution (EFC), and cost of attendance. The maximum Pell Grant amount for the 2022-23 academic year is $7395, although the actual amount awarded can vary depending on individual circumstances.

Maximum Pell Grant Amounts

The amount a student can receive through the Pell Grant is by several key factors:

- The Expected Family Contribution (EFC), derived from FAFSA information, significantly influences the grant amount.

- The cost of attendance also affects the total Pell Grant award.

- The student’s enrollment status (full-time or part-time) impacts the grant amount.

Students who enroll in three terms within an academic year may receive up to 150 percent of their scheduled Pell Grant award, allowing them to maximize their funding and potentially accelerate their educational journey. This flexibility in funding is to accommodate varying academic schedules and needs, ensuring that eligible students receive the support they need to succeed.

Eligibility Criteria for the Pell Grant

Eligibility for the Federal Pell Grant primarily targets undergraduate students who demonstrate significant financial need. Typically, this includes students who have not yet earned a bachelor’s degree, although some postbaccalaureate teacher certification students may also qualify. Prospective applicants must understand the eligibility criteria to determine their qualification for this important financial aid.

Several factors influence a student’s eligibility for a Pell Grant, including their financial need, calculated through the FAFSA, and their enrollment status. Additionally, students must be U.S. citizens or eligible non-citizens and eligible for a pell.

The Pell Grant program also imposes a lifetime limit of six years or 12 terms of funding, ensuring that students have ample opportunity to complete their undergraduate education.

Financial Need Assessment

Financial need is a pivotal factor in determining eligibility for the Pell Grant. This need is by evaluating a student’s cost of attendance against their Expected Family Contribution (EFC), which is from the information provided on the FAFSA. The FAFSA serves as a comprehensive tool for collecting data on a student’s financial situation, which is then to calculate their EFC.

Students need to understand the financial need assessment process to estimate their Pell Grant eligibility. Accurately completing the FAFSA ensures proper evaluation of financial needs, thus increasing the chances of receiving the maximum Pell Grant award.

Enrollment Status

A student’s enrollment status significantly affects their eligibility for the Pell Grant. Typically, full-time students are eligible for the full amount of the Pell Grant, while part-time and less-than-half-time students may receive prorated awards. This differentiation ensures that funding is allocated based on the student’s actual level of participation in their academic program.

Keeping the appropriate enrollment status is vital for maximizing Pell Grant funding. Changes in enrollment status, such as dropping from full-time to part-time, can result in adjustments to the grant amount received, impacting the overall financial aid package.

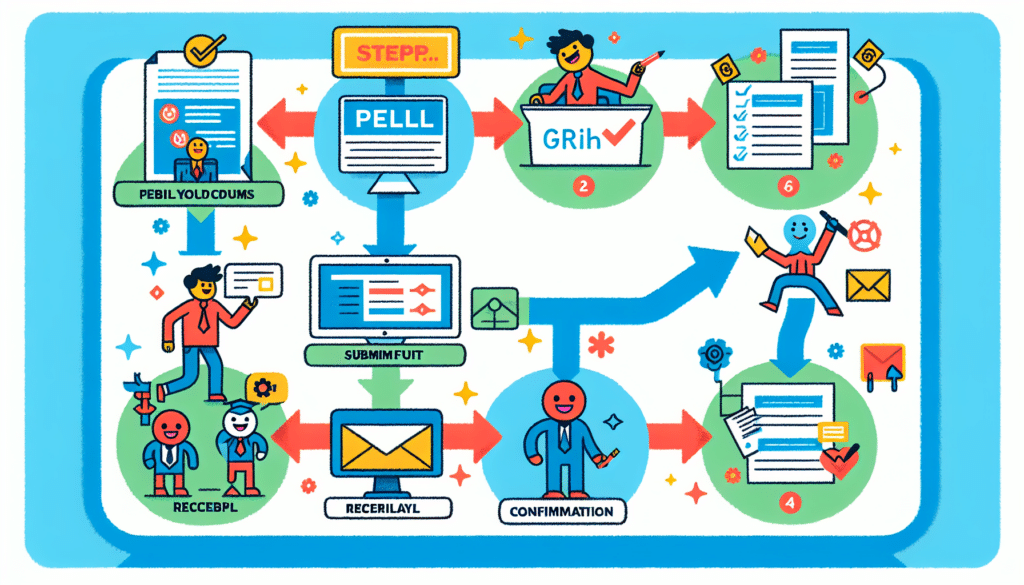

How to Apply for the Pell Grant

Applying for the Pell Grant requires completing the Free Application for Federal Student Aid (FAFSA), a critical step in determining eligibility for various forms of federal student aid, including the Pell Grant. Before starting the FAFSA, students should gather essential financial documents to streamline the application process. Accurately completing all sections of the FAFSA is essential for securing the Pell Grant and other federal financial aid.

The FAFSA form is annually to maintain eligibility for the Pell Grant. Submitting the application before the deadline is vital to avoid losing financial aid for the academic year.

The application process, while detailed, is a necessary step in unlocking significant financial support for higher education.

Important Deadlines

Submissions for the FAFSA open every year on October 1, and it is essential to apply as early as possible to maximize financial aid eligibility. For the 2023-24 award year, the FAFSA must be by June 30, 2024, but individual states and colleges may have earlier deadlines. Early submission can enhance eligibility for various forms of aid, including state and institutional grants.

Early application provides time to resolve any issues or errors, avoiding delays in receiving financial aid. By staying ahead of deadlines, students can secure the financial resources needed for their academic journey.

Required Documentation

Completing the FAFSA requires several critical documents, including federal tax returns and a Social Security number. Accurate documentation is essential for assessing financial need and determining eligibility for the Pell Grant and other forms of federal student aid. For more information, visit the federal student aid website.

Gathering and accurately entering all required documents into the FAFSA streamlines the application process, reducing the chances of delays or errors. Proper preparation is essential for a successful application, paving the way for financial support through the Pell Grant program.

Disbursement of Pell Grant Funds

Once awarded, Pell Grant funds are typically disbursed directly to the student’s college or university to cover tuition, fees, room, and board. Any remaining funds after these expenses are paid may be issued to the student to cover other educational costs, such as books and supplies.

The disbursement process usually occurs in two parts during each semester, with an initial portion covering 25% of the total award and the remaining 75% disbursed later in the term. If a student withdraws from classes before 60% of the semester is over, the college will reassess the amount of the Pell Grant the student is eligible to keep based on their attendance.

Maintaining Pell Grant Eligibility

To maintain eligibility for the Pell Grant, students must meet several requirements throughout their academic career. This includes being enrolled in at least six credit hours to maintain half-time status for financial aid purposes. Verification of enrollment status by the seventh day of the semester is important, as changes can affect the total Pell Grant amount received.

Students must also complete at least 67% of their attempted courses to maintain satisfactory academic progress. Failure to do so can result in financial aid suspension, impacting their ability to receive Pell Grant funds in the future. Additionally, students must complete their degree within 150% of the program’s published credit hours.

Federal regulations also state that repeated courses may not count towards the enrollment status used for financial aid eligibility. Staying informed about these requirements ensures continued access to vital financial support.

Additional Funding Options

While the Pell Grant provides substantial support, students may need additional funding to cover all college expenses. Scholarships, often based on academic performance or specific talents, are available from various nonprofits and private entities. These scholarships can significantly supplement Pell Grant funds, reducing the overall financial burden.

The Federal Work-Study Program is another valuable option, allowing students to earn money for their education by working part-time while studying. Additionally, student loans, which require repayment with interest, can be included in financial aid offers to help cover remaining costs. Exploring these options ensures that students have a comprehensive financial plan for their education.

Summary

In conclusion, the Federal Pell Grant is a vital resource for students from low-income families, providing non-repayable financial aid to support their educational goals. Understanding the eligibility criteria, application process, and requirements for maintaining eligibility is crucial for maximizing the benefits of this grant.

By combining Pell Grant funds with other forms of financial aid, such as scholarships, work-study programs, and student loans, students can create a robust financial plan to cover the costs of higher education. Taking proactive steps to secure and maintain financial aid ensures a smoother academic journey and a brighter future.

Frequently Asked Questions

The maximum Pell Grant amount for the 2023-24 academic year is $7395.

Financial need for Pell Grant eligibility is determined by comparing the cost of attendance to the Expected Family Contribution (EFC), which is derived from data submitted on the FAFSA. This assessment ensures that assistance is provided based on the student’s financial circumstances.

Graduate students typically do not qualify for Pell Grants, as these are primarily designated for undergraduate students who have not earned a bachelor’s degree. Exceptions may apply for certain postbaccalaureate teacher certification programs.

To apply for the Pell Grant, students must provide federal tax returns, a Social Security number, and additional financial documents as required. It is crucial to gather these items to ensure a smooth application process.

Withdrawing from classes before 60% of the semester may result in a reassessment of the student’s eligibility for the Pell Grant based on their attendance. It is crucial to understand the financial implications of such a decision.